Sell YOUR Home For More Money

In Only 28 Days!

Enter Your Details Find Out How The 10-Day Selling System Works

Luxury Real Estate in {Your Area}

Find Your Dream Home

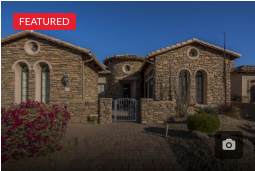

OUR FEATURED LISTINGS

SALE PENDING

$4,000,000

889 MARTINS CHAPEL ROAD

ANYWHERE, CA 90000

4 Bedrooms | 3 Bathrooms | 1500 sq. ft

CURRENTLY SHOWING

$4,000,000

889 MARTINS CHAPEL ROAD

ANYWHERE, CA 90000

4 Bedrooms | 3 Bathrooms | 1500 sq. ft

CURRENTLY SHOWING

$4,365,000

7807 N Calle Caballeros

PARADISE VALLEY, AZ 90000

4 Bedrooms | 3 Bathrooms | 1500 sq. ft

WHAT OUR HAPPY CLIENTS ARE SAYING...

Jessica S.

"Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae."

Vincent G.

"Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae."

Mariah F.

"Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae."

WHY I DO

WHAT I DO...

This is where you tell your story and share your reasons why you are passionate about what you do.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae. Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.